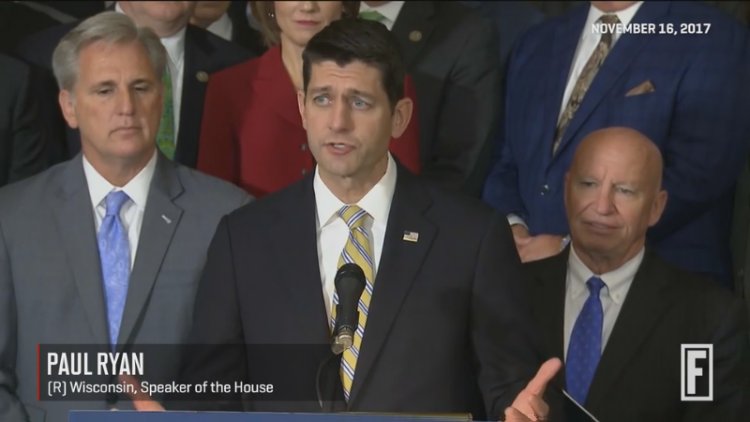

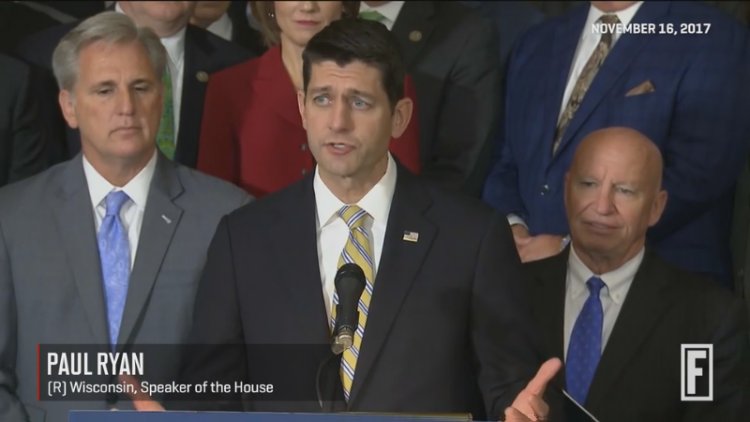

Paul Ryan reacts to the House passing the GOP's tax bill. He said he is 'so proud.' |

Paul Ryan reacts to the House passing the GOP's tax bill. He said he is 'so proud.' |

House Republicans passed a major tax bill Thursday, approving a piece of legislation with the potential to alter the finances of every business and household in the U.S. The GOP's "Tax Cut and Jobs Act" cleared the House by a margin of 227-205. Thirteen Republicans were among the representatives who voted against the bill.

"Tax reform is so very hard, but we know that there are people who are really struggling in this country," said Speaker of the House Speaker Paul D. Ryan (R-Wis.) following the bill's passage. "We know that we are just coming through a decade of real economic anxiety. And we know that this is a nation that has so much more potential that has not yet been tapped. That's what this day is about. That's what getting this done is about."

The vote is a much needed—if only short-term—win for President Trump and the GOP, as the administration approaches the close of its first year without any major legislative victories to speak of. The House GOP's plan proposes to radically simplify the tax code, as well as provide significant cuts to both individuals and businesses.

Items among the plan's highlights include reducing the tax brackets from seven to four and raising the lowest rate from 10% to 12%. The standard deduction would also double, and personal exemptions would be eliminated. In addition, many popular deductions would be eliminated, including those for medical expenses, mortgage interest, and state and local income taxes.

On the business side, corporate tax rates would drop from the current 35% to 20%. Business equipment expenditures would be able to be taken all at once, rather than amortized, and state and local taxes would still be deductible.

Next, the Senate must approve its version of tax reform—a challenge with little margin for error—and then the two chambers of Congress can go through the reconciliation process to settle the differences between their two bills. One key difference between the House and the Senate plan is the latter's inclusion of a repeal of Obamacare's individual mandate.

Linking taxes with healthcare—a legislative issue that has stymied Republicans this year—may prove to make a tough sell even tougher. As currently written, one Senate Republican already opposes his party's tax plan. According to the Congressional Budget Office, repealing the individual mandate would lead to 13 million people without insurance, an issue that caused concern with Sen. Susan Collins (R-Maine) during healthcare reform negotiations.